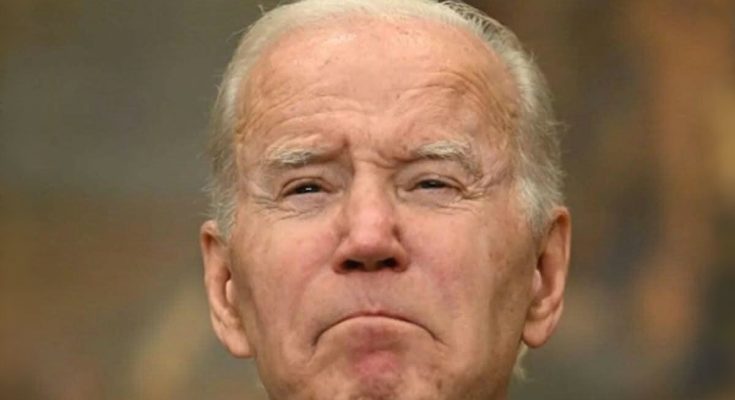

WASHINGTON, D.C. – In a bold move to reshape the federal government, President Donald Trump has dismissed the head of the Consumer Financial Protection Bureau (CFPB), a holdover from former President Joe Biden’s administration. The decision underscores Trump’s aggressive approach to dismantling the last vestiges of Biden’s policies and appointees.

As is customary when a new administration takes over, many officials from the previous leadership voluntarily step down. However, some choose to remain in their positions, either out of loyalty to their work or in hopes of continuing their influence under the new government. In this case, the now-former CFPB director declined to resign and was ultimately removed from office by the president.

Trump’s Push for a New Direction

The CFPB, originally established under President Barack Obama as part of the Dodd-Frank Act, has long been a point of contention between conservatives and liberals. While Democrats argue that the bureau plays a critical role in protecting consumers from predatory financial practices, many Republicans view it as an overreaching government agency that stifles economic growth with excessive regulations.

By removing Biden’s CFPB chief, Trump is signaling a shift in regulatory policies. The administration has indicated plans to overhaul financial regulations to promote free-market competition and reduce government intervention. A White House spokesperson stated, “President Trump is committed to ensuring that every federal agency reflects his administration’s vision for economic prosperity and limited government. This includes leadership changes at agencies like the CFPB, which have operated with little accountability for far too long.”

A History of Political Clashes

This is not the first time that leadership at the CFPB has been embroiled in political controversy. Under previous administrations, disputes over the bureau’s structure, funding, and leadership appointments have often led to legal battles and legislative fights. Trump’s latest action is expected to ignite further debates over the role of the CFPB and the extent to which an incoming president should have the power to remove agency heads.

Critics argue that removing the CFPB chief is a dangerous precedent that could weaken the agency’s independence. “The CFPB was designed to be an independent watchdog for consumers, free from political interference,” said a Democratic lawmaker. “This move is yet another example of President Trump prioritizing corporate interests over the needs of everyday Americans.”

Supporters of Trump’s decision, however, believe that the removal was necessary to ensure that the bureau aligns with the administration’s economic policies. “The CFPB has been an unchecked regulatory behemoth for far too long,” said a Republican senator. “It’s about time we have leadership that respects business growth and financial innovation.”

What Comes Next?

With the previous director gone, speculation is mounting over who will be appointed as the new head of the CFPB. Trump’s administration is expected to nominate a candidate who will push for deregulation and a more business-friendly approach. The confirmation process may face significant opposition from Senate Democrats, who have vowed to challenge any attempts to weaken consumer protections.

In the meantime, financial institutions and consumer advocacy groups alike are closely watching the developments. While some anticipate a loosening of regulatory constraints, others worry about potential rollbacks of protections designed to prevent financial abuse and unfair practices.

Conclusion

Trump’s decision to remove Biden’s CFPB chief is part of a broader effort to reshape the federal government in line with his administration’s policies. As the new leadership at the CFPB takes shape, the move is likely to fuel further political battles over the future of financial regulation in the United States. One thing is certain: Trump’s leadership shake-up signals a new chapter for the agency and the consumers it serves.